BOSTON , /PRNewswire/ — The brand new Government Home loan Bank of Boston revealed its original, unaudited 3rd quarter outcomes for 2024, reporting net income away from $sixty.4 mil to the one-fourth. The bank expects in order to document their quarterly report to the Mode 10-Q on the quarter ending , to the U.S. Ties and you may Change Commission the following month.

36%, this new each and every day mediocre of Secured At once Capital Speed to your 3rd quarter out-of 2024 and 3 hundred basis circumstances. New dividend, based on mediocre stock a fantastic towards 3rd quarter out of 2024, could well be reduced to your . As always, returns remain at this new discernment of the panel.

“FHLBank Boston’s good financial performance will continue to service a general range out-of liquidity and you will resource solutions for the professionals, plus present programs and you can effort you to definitely increase housing cost and you may improve society advancement throughout the The latest The united kingdomt,” told you President and you will Chief executive officer Timothy J. Barrett . “We were pleased to has just launch the newest CDFI Get better concerned about providing Society Innovation Loan providers and also the Permanent Rate Buydown equipment designed to create homeownership a great deal more achievable to have lower-income home because of focus-speed decrease as high as dos percentage activities.”

For the 3rd one-fourth off 2024, the brand new Government Open-market Panel (FOMC) paid off the mark assortment for the federal financing price from the fifty base items, to help you ranging from 475 and you can five hundred foundation items. In quarter, the newest yield bend remained upside down since the intermediate- and you may a lot of time-term rates of interest decreased dramatically reflecting a weakened economic outlook.

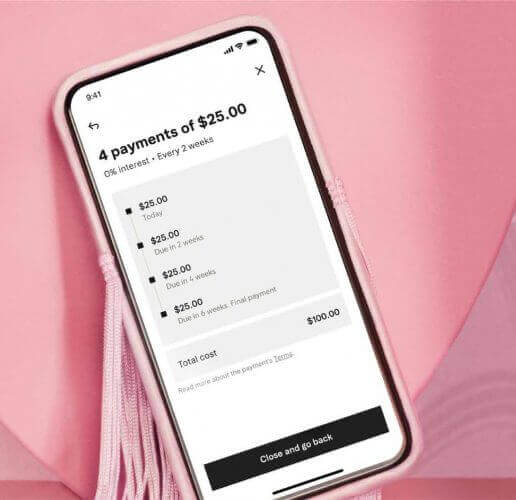

The bank has just introduced the Long lasting Rates Buydown device to possess mortgage finance ordered away from playing creditors that is designed and then make homeownership so much more possible to own low income households. The item permits our financial and you may borrowing commitment members that utilize the loan Union Funds (MPF ) System to minimize interest rates paid off because of the money-qualified individuals of the up to dos commission circumstances.

Net income to the 90 days concluded , was $60.cuatro million , compared with net income away from $70.1 million for the same age of 2023, mainly caused by a reduction in websites notice money just after decrease in borrowing losses regarding $14.step three billion , counterbalance of the a boost in most other earnings out-of $3.4 million . These overall performance resulted in an excellent $six.seven mil legal contribution towards the Bank’s Affordable Houses System to possess the fresh quarter. In addition, the lending company generated a volunteer sum off $507,000 with the Sensible Construction System and you can good $cuatro.6 billion contribution to our discretionary houses and people capital applications (5) toward quarter concluded .

The fresh new Bank’s full result of procedures are influenced by the fresh new cost savings, rates of interest and members’ demand for enhances

Websites attention money shortly after reduced total of borrowing from the bank losings for the about three weeks concluded , are $89.8 billion , weighed against $104.1 million for similar several months when you look at the 2023. The fresh new $14.3 mil decrease in websites notice earnings shortly after provision getting borrowing from the bank losses try primarily motivated from the a beneficial $thirteen.5 million boost in financial-recognized safeguards internet amortization, and you can a good $nine.4 million bad difference in the web unrealized progress and loss towards the reasonable well worth hedge payday loan Semmes ineffectiveness, both due to a decrease in intermediate- and you can enough time-name interest rates inside quarter ended , compared to the a boost in intermediate- and you will enough time-label interest rates into the same period when you look at the 2023. New reduced amount of web interest money shortly after reduced total of credit losses try partially offset because of the grows out of $step 3.4 mil , $dos.5 mil , and you may $572.9 mil inside our mediocre advances, mortgage-supported bonds, and you will home loan portfolios, respectively.

The Bank’s panel off directors has actually declared a dividend equivalent to an annual produce from 8

Online attention spread was 0.19% to your 3 months ended , a age months when you look at the 2023, and you will web attract margin are 0.52%, a fall out of thirteen base activities regarding three months finished . The newest decrease in web attract bequeath and you will margin is actually generally attributable on good reduced total of intermediate- and you may long-identity interest levels.