In this post

- Downpayment Matter

- Deposit Commission

- Average Down-payment

- Serious Money

If at all possible, brand new advance payment to your one new house pick would be to if at all possible getting at the least 20%, no matter if recent changes in credit keeps triggered lower criteria. It’s always best if you speak to your mortgage lender to decide how much cash just be sure to lay out. Generally, an essential downpayment count has actually varied between 10% and you may 20%, however with brand new financing applications, necessary advance payment numbers was changing.

The fresh new down payment number necessary for a $600K house depends on their lender’s standards as well as your personal items. Many people have zero down-payment conditions, and others pays as little as step 3% or 5% of the conversion process rates. Getting along the simple 20% makes it possible to avoid investing financial insurance rates and focus and might save you several thousand dollars. So you’re able to expect to pay ranging from $18,000 and you can $120,000 once the a deposit to your an excellent $600,000 get. Bear in mind, besides the advance payment matter, there are also to help you reason behind settlement costs.

Nearly all loan providers wanted a down payment. Financial institutions generally use a great Vantage score if you are Credit scores are used from the almost every other loan providers. Whenever you are unsure hence means a specific bank spends, you can contact the new lending institution and ask how much from a down-payment they expect.

To determine your ideal deposit you must very first dictate your own budget. The best way to assess how much cash you can afford for each times, comment the bank card and you may financial comments. Centered on the conclusions you should have sensible of how much home you can afford, this can give you a range of the prospective down-payment matter. It’s important to has actually the absolute minimum advance payment percentage, no matter what brand of loan you’ll get.

Playing with an ending prices calculator is the best treatment for determine approximately what you would need certainly to give new table towards closure time.

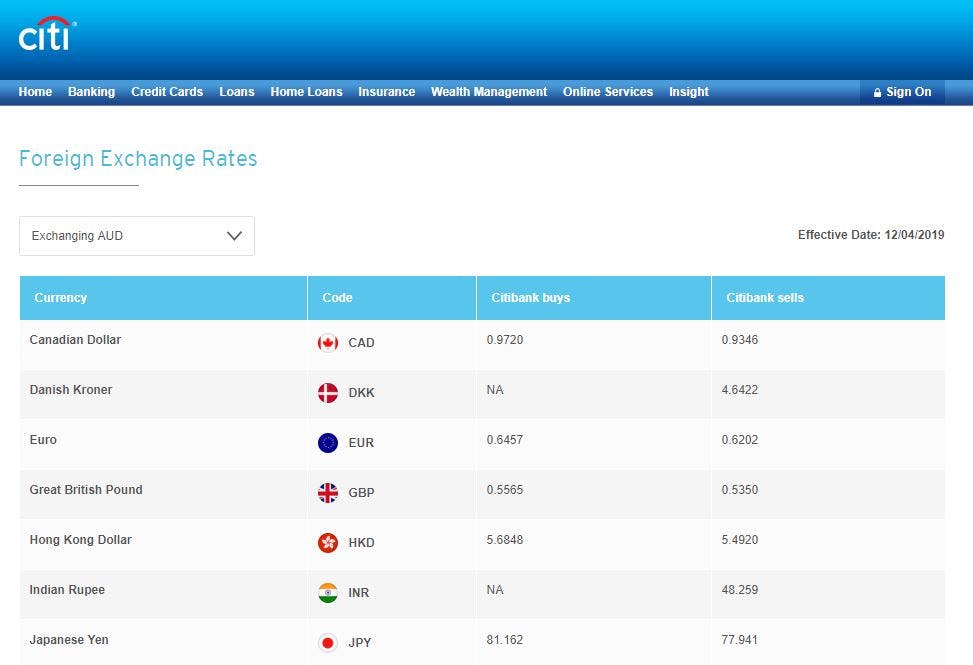

The brand new down-payment payment to have a good $600K domestic varies, and that is dependent on your own personal financial predicament and you may mortgage bundle. Some people have the ability to place absolutely nothing off, while others will need to set-out at the least step three%. Although not, of numerous lenders choose which you lay at the least 20% off, that will save several thousand dollars into the financial insurance rates and you can focus. The payment that you establish depends towards the style of mortgage your qualify for. Here is an easy table with various advance payment percentages to possess an excellent $600,000 financial.

Our home Purchasing Institute advises placing down 20% or more. However, the amount you can afford hinges on the money you owe and your local area. When you should be ready to make a down-payment one you can afford, it is best to keeps a quotation available to you. A down-payment is the most significant bills within the family-to shop for procedure. Plus the deposit, you’ll have to spend closing costs, particularly lender’s name insurance coverage, financial activities, and you can an assessment or questionnaire fee.

Average Down payment

If you are looking to purchase a house, you possibly need to put down way too much money within closing. Given that average advance payment https://cashadvancecompass.com/payday-loans-nc/ having a great $600,000 residence is 20%, most people put down less than this. The fresh down payment calculator makes it possible to plan your own discounts and you will budget to place along the minimum you can easily. Additionally, the brand new calculator helps you dictate what kind of cash your have to save your self monthly.

Saving money for a down payment shall be problematic for certain, because the average lowest deposit on an effective $600K residence is $18,000 or maybe more, while you place regarding closing costs, that can total up to $42,000 or even more. An average monthly homeloan payment that have PMI is about $step three,200. It is important to just remember that , the total amount you will need to place down depends upon your credit rating, your debt-to-income proportion, the kind of mortgage, the interest rate additionally the period of time you’re going to be when you look at the the house.

Earnest Currency

Serious money is a way to show a provider which you is serious about to purchase their house. It is usually a price between step one% and you can 3% of the agreed upon purchase price. Therefore getting a price from $600,000 you could expect to put down between $6,000 and $18,000. The brand new agreed upon count is then listed in a keen escrow membership before purchase are closed. While the pick experience and within the closure techniques the fresh money could be put out and additionally be used towards your off fee. So ensure that you factor that it for the whenever thinking about how much cash deposit do you consider you really can afford.